Understanding Net Worth: A Comprehensive Guide To Wealth Management And Financial Success

Net worth is a critical measure of an individual's financial health, representing the difference between their assets and liabilities. It serves as a foundation for understanding financial stability and evaluating progress towards long-term goals. Whether you're a beginner in personal finance or an experienced investor, grasping the concept of net worth is essential for building wealth and achieving financial independence.

Many people focus on income as the primary indicator of financial success. However, net worth provides a more accurate picture of someone's financial standing by considering both what they own and what they owe. In this article, we will explore the concept of net worth in-depth, how to calculate it, and strategies for improving it over time.

By the end of this guide, you will have a clear understanding of how to assess your financial health, set realistic goals, and implement actionable steps to grow your net worth. Let's dive into the world of personal finance and wealth management!

Read also:Evil Neuro Birthday 2025 A Comprehensive Guide To The Celebrated Event

Table of Contents

- What Is Net Worth?

- How to Calculate Net Worth

- The Importance of Net Worth

- Factors Affecting Net Worth

- Strategies to Improve Net Worth

- Common Mistakes to Avoid

- Net Worth by Age Statistics

- Celebrity Net Worth Examples

- Tools for Tracking Net Worth

- Conclusion

What Is Net Worth?

Net worth is a financial metric that quantifies an individual's or entity's overall financial position. It is calculated by subtracting total liabilities from total assets. A positive net worth indicates financial stability, while a negative net worth suggests financial challenges that need addressing.

Understanding net worth is crucial for several reasons:

- It provides a snapshot of your financial health.

- It helps in setting realistic financial goals.

- It serves as a benchmark for measuring financial progress over time.

Key Components of Net Worth

Net worth consists of two primary components:

- Assets: Anything of monetary value that you own, such as cash, real estate, investments, vehicles, and personal belongings.

- Liabilities: Outstanding debts or obligations, including mortgages, loans, credit card balances, and other financial commitments.

How to Calculate Net Worth

Calculating your net worth is a straightforward process that involves listing all your assets and liabilities and performing a simple subtraction. Here's how you can do it step-by-step:

Step 1: List Your Assets

Make a comprehensive list of all your assets, including:

- Cash and savings accounts

- Investments (stocks, bonds, mutual funds)

- Real estate properties

- Vehicles

- Personal belongings with significant value

Step 2: List Your Liabilities

Next, list all your liabilities, which may include:

Read also:Endousaya A Comprehensive Guide To Understanding And Maximizing Its Potential

- Mortgage balances

- Student loans

- Credit card debt

- Car loans

- Other financial obligations

Step 3: Perform the Calculation

Once you have a complete list of your assets and liabilities, subtract the total liabilities from the total assets:

Net Worth = Total Assets - Total Liabilities

The Importance of Net Worth

Net worth is more than just a number; it is a reflection of your financial well-being. Here are some reasons why tracking your net worth is essential:

1. Financial Awareness

Knowing your net worth gives you a clear understanding of your financial situation, enabling you to make informed decisions about spending, saving, and investing.

2. Goal Setting

Whether you're aiming to buy a home, retire early, or start a business, your net worth serves as a foundation for setting and achieving financial goals.

3. Wealth Building

By regularly monitoring your net worth, you can identify areas where you can improve your financial position and work towards increasing your wealth over time.

Factors Affecting Net Worth

Several factors can influence your net worth, both positively and negatively. Understanding these factors can help you manage your finances more effectively:

Positive Factors

- Increased income and savings

- Appreciation of assets (real estate, investments)

- Debt reduction

Negative Factors

- Decreased income or job loss

- Asset depreciation (vehicles, electronics)

- Accumulation of debt

Strategies to Improve Net Worth

Improving your net worth requires a combination of increasing assets and reducing liabilities. Here are some strategies to help you achieve this goal:

1. Increase Income

Explore opportunities to boost your income, such as asking for a raise, pursuing a higher-paying job, or starting a side business.

2. Save and Invest Wisely

Set aside a portion of your income for savings and invest in diversified portfolios to grow your wealth over time.

3. Reduce Debt

Prioritize paying off high-interest debts and avoid taking on unnecessary loans or credit card balances.

Common Mistakes to Avoid

While striving to improve your net worth, it's important to avoid common pitfalls that can hinder your progress:

1. Overspending

Living beyond your means can lead to accumulating debt and negatively impact your net worth. Practice mindful spending and stick to a budget.

2. Neglecting Investments

Failing to invest your money can prevent you from taking advantage of compound interest and long-term wealth growth. Start investing early and consistently.

3. Ignoring Insurance

Not having adequate insurance coverage can leave you vulnerable to financial losses. Ensure you have the necessary protection for your assets and health.

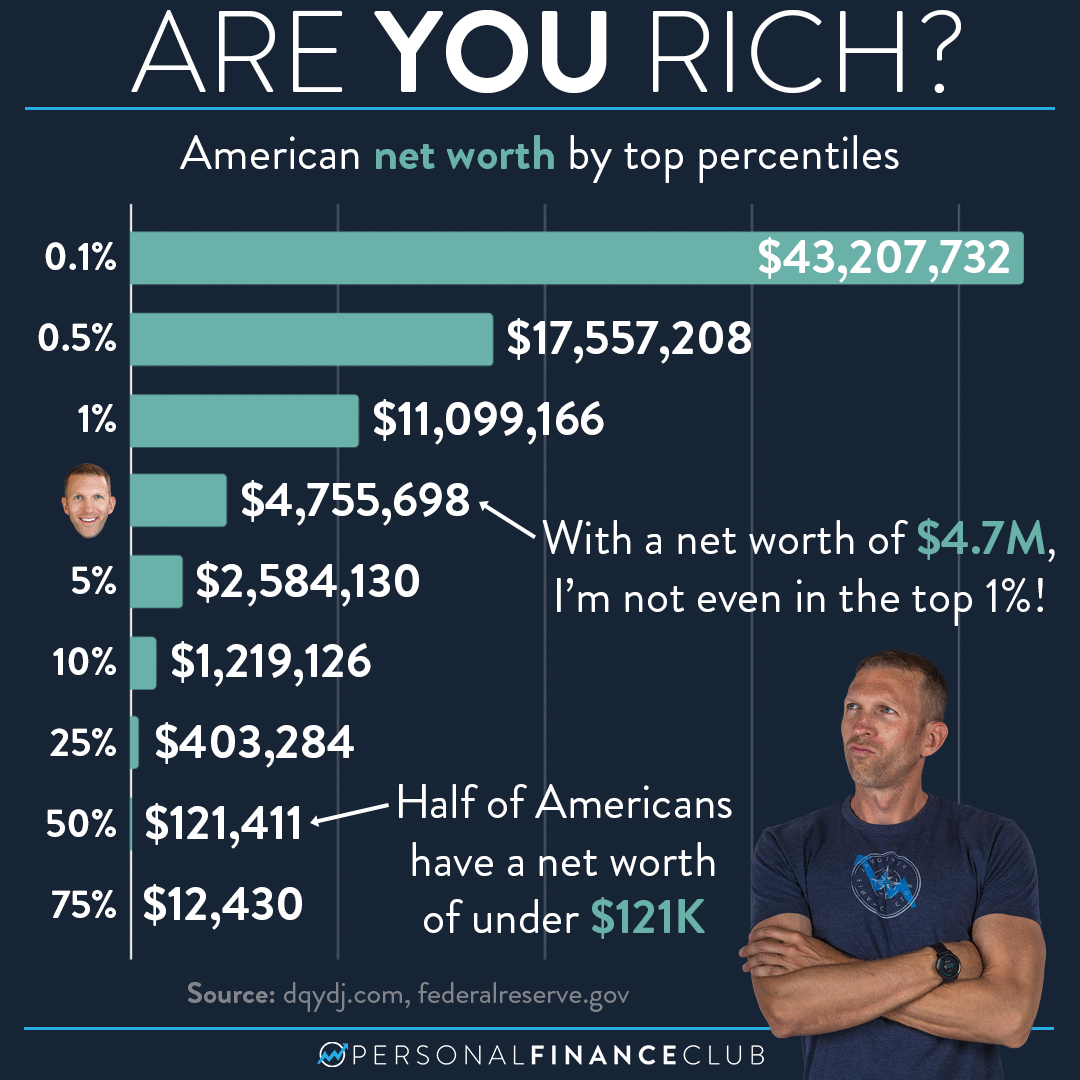

Net Worth by Age Statistics

According to data from the Federal Reserve, the average net worth varies significantly by age group. Here are some statistics to provide context:

- Under 35: Average net worth of $76,200

- 35-44: Average net worth of $436,200

- 45-54: Average net worth of $833,200

- 55-64: Average net worth of $1,175,900

- 65+: Average net worth of $1,066,000

These figures provide a benchmark for comparing your financial progress with others in your age group. However, remember that individual circumstances vary, and it's essential to focus on your unique financial goals.

Celebrity Net Worth Examples

Many celebrities have amassed substantial net worths through their careers and investments. Here are a few examples:

Biography of Jeff Bezos

Jeff Bezos, the founder of Amazon, is one of the wealthiest individuals in the world. Below is a summary of his personal information:

| Full Name | Jeffrey Preston Bezos |

|---|---|

| Date of Birth | January 12, 1964 |

| Net Worth | $114 billion (as of 2023) |

| Profession | Entrepreneur, Business Magnate |

Tools for Tracking Net Worth

Several tools and apps are available to help you track and monitor your net worth effectively:

1. Mint

Mint is a popular budgeting app that allows you to connect your financial accounts and automatically calculates your net worth.

2. Personal Capital

Personal Capital offers a comprehensive platform for tracking net worth, investments, and retirement planning.

3. Excel or Google Sheets

For those who prefer a more hands-on approach, creating a spreadsheet to manually track assets and liabilities can be an effective method.

Conclusion

In conclusion, understanding and managing your net worth is crucial for achieving financial success and independence. By calculating your net worth regularly, implementing strategies to improve it, and avoiding common mistakes, you can take control of your financial future.

We encourage you to take action today by assessing your current net worth and setting realistic goals for improvement. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our website for more insights into personal finance and wealth management.

References:

- Federal Reserve - Survey of Consumer Finances

- Forbes - Celebrity Net Worth Rankings

- Investopedia - Net Worth Definition and Calculation

Victoria-Jane Verstappen: The Rising Star In The Spotlight

Iron Man 2 Actress: Exploring The Talented Women Behind The Iconic Roles

Drake's Kids: A Comprehensive Look Into The Life And Legacy Of Drake’s Children

How to calculate your net worth Personal Finance Club

US Net Worth By Top Percentiles Breakdown Personal Finance Club

NET WORTH OF A LIFE