Comprehensive Guide To CFCCU: Unlocking The Potential Of Your Financial Future

In today's rapidly evolving financial landscape, understanding credit unions has become more important than ever. CFCCU, or Community First Credit Union, stands as a beacon of trust and reliability for individuals seeking personalized banking solutions. As a member-owned financial cooperative, CFCCU offers unique benefits that differentiate it from traditional banks. Whether you're looking to save, invest, or borrow, CFCCU provides a comprehensive suite of services tailored to meet your financial needs.

Established with the mission to empower its members, CFCCU has consistently demonstrated its commitment to delivering exceptional service and value. The credit union operates on principles that prioritize member satisfaction, ensuring that every individual receives personalized attention and support. This dedication to excellence has earned CFCCU a reputation as one of the most trusted financial institutions in its region.

As we delve deeper into this guide, you will discover the intricacies of CFCCU's operations, the benefits of becoming a member, and how this credit union can help you achieve your financial goals. Whether you're a seasoned investor or just starting your financial journey, CFCCU offers tools and resources to help you succeed. Let's explore the world of CFCCU and uncover the opportunities it presents for your financial future.

Read also:Comprehensive Guide To Printsmart Uark Login Everything You Need To Know

Table of Contents

- Introduction to CFCCU

- History and Background

- Services Offered by CFCCU

- Becoming a Member

- Benefits of Membership

- Financial Tools and Resources

- Community Involvement

- CFCCU vs. Traditional Banks

- Member Testimonials

- Future Plans and Innovations

Introduction to CFCCU

CFCCU, or Community First Credit Union, is a member-owned financial cooperative that operates with the primary goal of serving its members. Unlike traditional banks, CFCCU prioritizes the financial well-being of its members over profit margins. This unique approach has garnered a loyal following and established CFCCU as a leader in the credit union industry.

Core Values

The core values of CFCCU revolve around integrity, transparency, and member satisfaction. These values guide every decision and action taken by the credit union, ensuring that members receive the highest level of service and support. By adhering to these principles, CFCCU has built a strong foundation of trust and reliability.

Member-Centric Approach

One of the standout features of CFCCU is its member-centric approach. Every member is treated as a valued partner, with access to personalized services and resources designed to meet their specific needs. This approach fosters a sense of community and belonging among members, making CFCCU more than just a financial institution—it's a family.

History and Background

The journey of CFCCU began several decades ago with a vision to provide affordable and accessible financial services to the local community. Over the years, the credit union has grown significantly, expanding its services and reach while staying true to its founding principles.

Founding and Growth

- Established in [Year] to serve the financial needs of local residents.

- Expanded its services to include a wide range of banking solutions.

- Continuously innovated to meet the evolving needs of its members.

Key Milestones

Throughout its history, CFCCU has achieved several key milestones that have solidified its position as a leader in the credit union industry. These milestones include the introduction of cutting-edge technology, expansion into new markets, and the implementation of programs designed to empower members financially.

Read also:Mila Kunis Kissing Natalie Portman A Comprehensive Look At The Viral Moment

Services Offered by CFCCU

CFCCU offers a comprehensive suite of services that cater to the diverse needs of its members. From traditional banking services to advanced financial tools, CFCCU ensures that every member has access to the resources they need to succeed financially.

Savings Accounts

CFCCU provides a variety of savings accounts designed to help members grow their wealth. These accounts offer competitive interest rates and flexible options to suit different financial goals.

Loan Products

- Personal loans

- Auto loans

- Mortgage loans

With competitive rates and flexible terms, CFCCU's loan products make it easier for members to achieve their financial objectives.

Becoming a Member

Joining CFCCU is a straightforward process that opens the door to a world of financial opportunities. To become a member, individuals must meet certain eligibility criteria and complete a simple application process.

Eligibility Requirements

Eligibility for CFCCU membership is based on factors such as residency, employment, or association with specific organizations. These requirements ensure that the credit union remains true to its mission of serving the local community.

Application Process

The application process is designed to be quick and convenient, allowing individuals to become members in no time. By completing the necessary paperwork and making a small deposit, individuals can enjoy the benefits of CFCCU membership.

Benefits of Membership

Membership in CFCCU comes with a host of benefits that make it an attractive option for individuals seeking financial stability and growth. From personalized service to exclusive offers, CFCCU members enjoy a range of advantages that set the credit union apart from traditional banks.

Personalized Service

CFCCU prides itself on offering personalized service to each member. This includes dedicated account managers, tailored financial advice, and responsive customer support.

Exclusive Offers

Members of CFCCU have access to exclusive offers and promotions that are not available to the general public. These offers include discounted rates on loans, special savings account incentives, and more.

Financial Tools and Resources

CFCCU provides a wealth of financial tools and resources to help members make informed decisions about their finances. These tools empower members to take control of their financial futures and achieve their goals.

Online Banking

CFCCU's online banking platform offers a secure and convenient way for members to manage their accounts from anywhere. Features include bill pay, account transfers, and transaction history.

Financial Education

CFCCU is committed to educating its members about financial literacy. The credit union offers workshops, seminars, and online resources to help members improve their financial knowledge and skills.

Community Involvement

CFCCU is deeply involved in the communities it serves, actively participating in local events and initiatives. This commitment to community involvement reinforces the credit union's mission to make a positive impact on the lives of its members and the broader community.

Local Events

CFCCU sponsors and participates in a variety of local events, from charity drives to educational seminars. These events provide opportunities for members to engage with the credit union and learn more about its services.

Charitable Contributions

CFCCU is dedicated to giving back to the community through charitable contributions and partnerships with local organizations. These efforts help address critical issues such as poverty, education, and healthcare.

CFCCU vs. Traditional Banks

When comparing CFCCU to traditional banks, several key differences become apparent. These differences highlight the unique advantages of choosing CFCCU as your financial partner.

Ownership Structure

As a member-owned credit union, CFCCU operates for the benefit of its members rather than shareholders. This structure ensures that profits are reinvested into the credit union and its services, rather than distributed as dividends.

Service Quality

CFCCU consistently receives high marks for service quality, with members praising the credit union's dedication to personalized attention and support. Traditional banks often struggle to match this level of service, resulting in lower customer satisfaction ratings.

Member Testimonials

Hear from real members about their experiences with CFCCU. These testimonials highlight the credit union's commitment to excellence and the positive impact it has on its members' lives.

Testimonial 1

"CFCCU has been a lifeline for me. Their personalized service and competitive rates have helped me achieve my financial goals." - Jane Doe

Testimonial 2

"I couldn't be happier with my decision to join CFCCU. The resources and tools they offer have made managing my finances easier than ever." - John Smith

Future Plans and Innovations

CFCCU is committed to staying at the forefront of the financial industry by embracing innovation and technology. The credit union's future plans include the introduction of new services, expansion into new markets, and continued investment in cutting-edge technology.

Upcoming Services

In the coming years, CFCCU plans to introduce new services that will further enhance the member experience. These services will include advanced mobile banking features, expanded loan options, and more.

Technological Advancements

CFCCU is investing heavily in technology to ensure that its members have access to the latest tools and resources. This includes upgrades to the online banking platform, enhanced security measures, and improved customer support systems.

Kesimpulan

In conclusion, CFCCU offers a unique and valuable proposition for individuals seeking a reliable and member-focused financial institution. With its comprehensive suite of services, personalized approach, and commitment to community involvement, CFCCU stands out as a leader in the credit union industry. By choosing CFCCU, members gain access to the resources and support needed to achieve their financial goals.

We invite you to take the next step in your financial journey by joining CFCCU. Whether you're looking to save, invest, or borrow, CFCCU has the tools and resources to help you succeed. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our site for more insights into the world of finance.

Thephantom202: Unveiling The Enigma Behind The Username

Elizabeth Dormer: The Legacy And Impact Of A Historical Figure

Did It Hurt When I Kicked You To The Curb: A Comprehensive Exploration

Philanthropy CFCCU

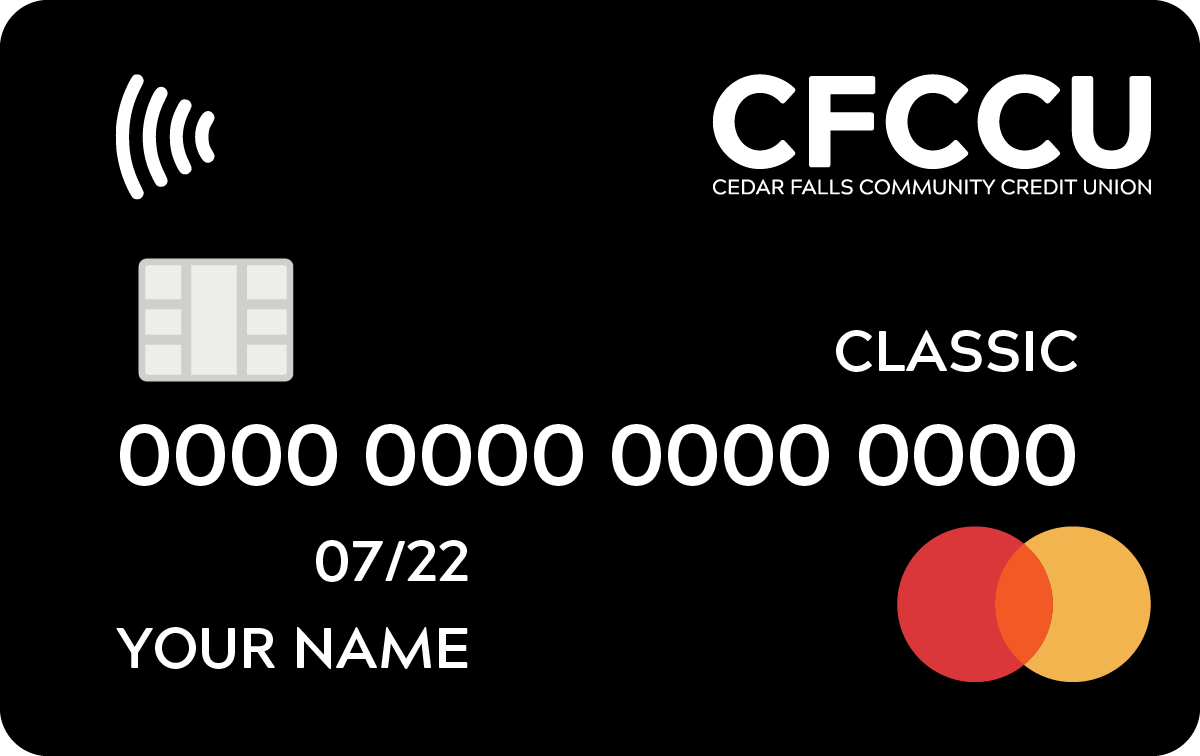

Credit Cards CFCCU

Stronger Together CFCCU