Understanding 1099-G Unemployment: A Comprehensive Guide To Your Money And Your Life

Unemployment benefits are a lifeline for many individuals during challenging economic times, but understanding the tax implications is crucial. When you receive unemployment compensation, the IRS requires your state to issue a 1099-G form to report the payments. This form is not just a piece of paper; it plays a significant role in your tax filings and financial planning. Understanding the 1099-G unemployment process ensures compliance with tax obligations and helps you avoid potential penalties.

Many taxpayers overlook the importance of the 1099-G form, especially when dealing with unemployment benefits. However, failing to report these payments correctly can lead to costly mistakes. In this article, we will explore everything you need to know about the 1099-G unemployment form, including its purpose, how to file it correctly, and strategies to minimize your tax burden.

Whether you're a first-time recipient of unemployment benefits or someone looking to refresh their knowledge, this guide aims to provide clarity and actionable insights. Let's dive into the details and empower you to take control of your financial situation.

Read also:Discover The Unique World Of Senju Beans A Comprehensive Guide

Table of Contents

- What is 1099-G Unemployment?

- How Does the 1099-G Form Work?

- Important Information on 1099-G Unemployment

- The Filing Process for 1099-G

- Tax Implications of Unemployment Benefits

- Common Questions About 1099-G Unemployment

- Strategies to Manage Tax Obligations

- Avoiding Common Mistakes with 1099-G

- Useful Resources for Taxpayers

- Conclusion and Next Steps

What is 1099-G Unemployment?

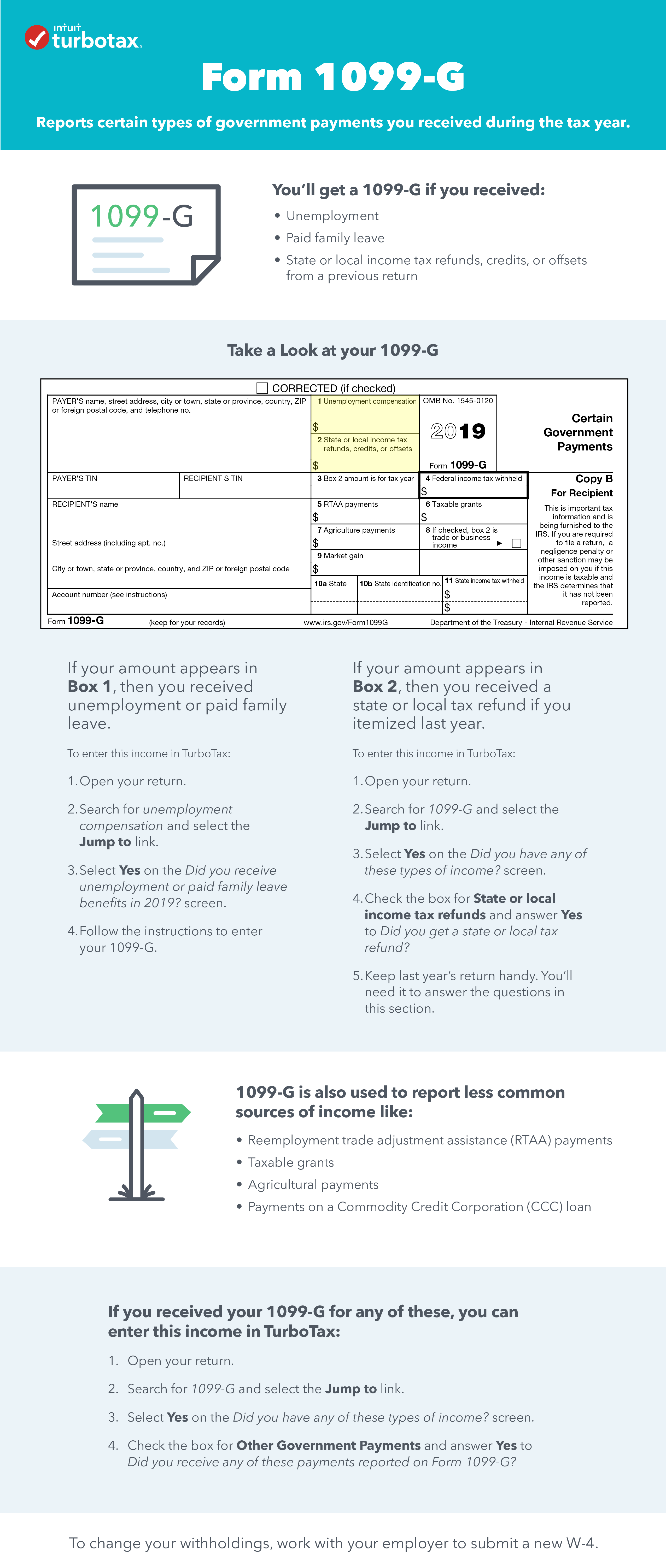

The 1099-G form is an official IRS document used to report certain types of government payments, including unemployment compensation. When you receive unemployment benefits, the state agency responsible for distributing these funds will send you a 1099-G form at the end of the tax year. This form outlines the total amount of unemployment benefits you received, which must be reported on your federal tax return.

Unemployment benefits are considered taxable income by the IRS, and the 1099-G form serves as proof of the payments you received. It is essential to understand that failing to include this information on your tax return can result in penalties or audits. The form also provides details about any federal income tax withheld from your benefits, which can impact your refund or tax liability.

Key Features of the 1099-G Form

Here are some critical features of the 1099-G form:

- Box 1: Shows the total amount of unemployment compensation received.

- Box 4: Indicates any federal income tax withheld from your benefits.

- Box 15: Provides a description of the payments reported in Box 1.

By understanding these components, you can ensure accurate reporting and avoid potential issues with the IRS.

How Does the 1099-G Form Work?

The 1099-G form works as a bridge between the state unemployment agency and the IRS. After the tax year ends, the state agency sends a copy of the 1099-G form to both the taxpayer and the IRS. This ensures transparency and accountability in reporting unemployment benefits.

Steps in the Process

The process involves the following steps:

Read also:Sandra Oh Ethnicity Exploring The Cultural Roots And Career Of A Global Icon

- The state agency calculates the total unemployment benefits paid to you during the year.

- They issue the 1099-G form by January 31st of the following year.

- You receive the form and use the information to complete your tax return.

- The IRS receives a copy of the form to verify your reported income.

Following these steps ensures that all parties are aligned and that your tax obligations are met.

Important Information on 1099-G Unemployment

Understanding the nuances of the 1099-G form is vital for accurate tax reporting. Here are some key points to consider:

Types of Payments Reported

The 1099-G form reports various types of government payments, including:

- Unemployment compensation

- State or local tax refunds

- Certain grants and awards

Each type of payment has specific reporting requirements, so it's essential to review your form carefully.

Deadlines and Extensions

The deadline for receiving your 1099-G form is January 31st. If you do not receive it by this date, contact your state unemployment agency promptly. In some cases, extensions may be granted, but it's best to act quickly to avoid delays in filing your taxes.

The Filing Process for 1099-G

Filing your taxes with a 1099-G form involves incorporating the information into your federal tax return. Here's how to do it:

Step-by-Step Guide

- Gather your 1099-G form and other necessary tax documents.

- Report the unemployment compensation amount from Box 1 on Form 1040, Line 7.

- Include any federal income tax withheld from Box 4 on Form 1040, Line 24a.

- Review your calculations and double-check for accuracy.

Using tax preparation software or consulting a tax professional can simplify this process and ensure compliance.

Tax Implications of Unemployment Benefits

Unemployment benefits are subject to federal income tax, and in some cases, state taxes as well. Understanding the tax implications is crucial for effective financial planning.

Impact on Tax Liability

The amount of unemployment benefits you receive directly affects your taxable income. Depending on your overall income and deductions, this could increase your tax liability or reduce your refund. For example, if you received a significant amount in unemployment benefits, you might fall into a higher tax bracket.

Options for Managing Taxes

To manage your tax obligations, consider the following options:

- Voluntarily withhold federal income tax from your unemployment benefits.

- Make quarterly estimated tax payments to cover your liability.

These strategies can help you avoid surprises when tax season arrives.

Common Questions About 1099-G Unemployment

Many taxpayers have questions about the 1099-G form and unemployment benefits. Here are some frequently asked questions and their answers:

Do I Need to Report All Unemployment Benefits?

Yes, all unemployment benefits must be reported on your tax return. The 1099-G form provides the necessary information to do so accurately.

What Happens If I Don't Receive My 1099-G Form?

If you do not receive your 1099-G form by the deadline, contact your state unemployment agency immediately. They can provide a duplicate or verify the information over the phone.

Strategies to Manage Tax Obligations

Managing your tax obligations effectively requires proactive planning. Here are some strategies to consider:

Withholding Options

When signing up for unemployment benefits, you can choose to have federal income tax withheld from your payments. This is similar to withholding taxes from a regular paycheck and can simplify your tax responsibilities.

Estimated Tax Payments

If you opt not to withhold taxes, making quarterly estimated tax payments is an alternative. This approach ensures that you meet your tax obligations throughout the year rather than facing a large bill at tax time.

Avoiding Common Mistakes with 1099-G

Mistakes with the 1099-G form can lead to penalties or audits. Here are some common errors to avoid:

- Forgetting to report unemployment benefits on your tax return.

- Incorrectly entering the amounts from the 1099-G form.

- Not accounting for federal income tax withheld.

Double-checking your work and seeking professional advice can help prevent these issues.

Useful Resources for Taxpayers

Several resources are available to assist taxpayers in understanding and filing their 1099-G forms:

- IRS Publication 17: Your Federal Income Tax

- State unemployment agency websites

- Tax preparation software and online tools

These resources provide detailed guidance and support to ensure accurate and timely filings.

Conclusion and Next Steps

Understanding the 1099-G unemployment form is essential for managing your tax obligations and financial well-being. By following the guidelines outlined in this article, you can ensure accurate reporting and avoid potential pitfalls. Remember to review your 1099-G form carefully, consult available resources, and consider seeking professional advice if needed.

We encourage you to take action by reviewing your tax situation and preparing your return with confidence. Share this article with others who may benefit from the information, and explore additional resources on our site for further guidance. Together, we can empower you to take control of your financial future.

Sagittarius And Pisces Compatibility: A Comprehensive Guide To Love, Life, And Understanding

Madyline Cline Nude: Understanding The Controversy And Setting The Record Straight

Madelyn Nude: A Comprehensive Exploration Of A Controversial Topic

1099 G Unemployment Nj 2021

What You Need to Know About Unemployment Form 1099G National

1099G Unemployment Compensation (1099G)