What Is 1099G: A Comprehensive Guide To Understanding Your Tax Document

Tax season can be overwhelming, especially when you encounter unfamiliar forms like the 1099G. This document plays a crucial role in your tax filing process, but many taxpayers are left confused about its purpose and implications. If you're wondering, "What is 1099G?" you're not alone. This guide will break down everything you need to know about the 1099G form, its significance, and how it impacts your tax return.

The 1099G form is issued by state or local governments to individuals who have received certain types of government payments during the year. Whether you’ve received unemployment benefits, tax refunds, or other government-related payments, this form is essential for accurately reporting your income to the IRS.

Understanding the 1099G is critical for ensuring compliance with tax laws and avoiding potential penalties. As we delve deeper into this topic, we’ll explore the details of the form, its components, and how it affects your tax obligations. Let’s get started!

Read also:Discover The Serenity Of 16375 Shadow Mountain Dr Your Ultimate Mountain Retreat

Table of Contents

- Introduction to 1099G

- What is 1099G?

- Types of Payments Reported on 1099G

- Who Receives the 1099G Form?

- How to Read Your 1099G

- Filing Taxes with 1099G

- Common Questions About 1099G

- Avoiding Common Mistakes

- Using Tax Software for 1099G

- Conclusion

Introduction to 1099G

The 1099G form is an official IRS document that reports certain types of income you may have received from state or local governments. It serves as a record of payments made to you, such as unemployment benefits, tax refunds, or other government-related payments. Understanding this form is essential for accurate tax reporting and compliance with federal tax laws.

Many taxpayers receive multiple forms during tax season, and the 1099G is just one of them. While it may seem complex at first glance, breaking it down into its components can help simplify the process. In this section, we’ll explore the basics of the 1099G and why it matters.

What is 1099G?

The 1099G form is issued by state or local governments to individuals who have received payments such as unemployment benefits, tax refunds, or other government-related income. The IRS requires these entities to report such payments to ensure accurate tax reporting. By receiving this form, you are notified of the income you need to include in your tax return.

Why is the 1099G Important?

The 1099G plays a critical role in your tax filing process. It provides a detailed breakdown of payments you’ve received from government entities, ensuring that you accurately report your income. Ignoring or misunderstanding this form can lead to errors in your tax return, potentially resulting in penalties or audits.

- It ensures compliance with federal tax laws.

- It helps you avoid underreporting income.

- It provides clarity on government payments you’ve received.

Types of Payments Reported on 1099G

The 1099G form covers a variety of payments made by state or local governments. These include:

- Unemployment Compensation: Payments received from unemployment benefits.

- Tax Refunds: State or local tax refunds you received during the year.

- Credit or Offset: Payments related to tax credits or offsets.

- Other Payments: Any other income received from government entities, such as grants or subsidies.

Each type of payment is reported in a specific box on the 1099G form, making it easier for you to identify and report the correct amounts.

Read also:Ateez Werverse Exploring The Rise And Impact Of Ateez On The Werverse Platform

Who Receives the 1099G Form?

Not everyone will receive a 1099G form. It is sent to individuals who meet certain criteria, such as:

- Those who received unemployment benefits during the year.

- Taxpayers who received state or local tax refunds.

- Individuals who received other government-related payments.

If you fall into any of these categories, you should expect to receive a 1099G form by January 31st of the following year. If you don’t receive it, contact the issuing agency to request a copy.

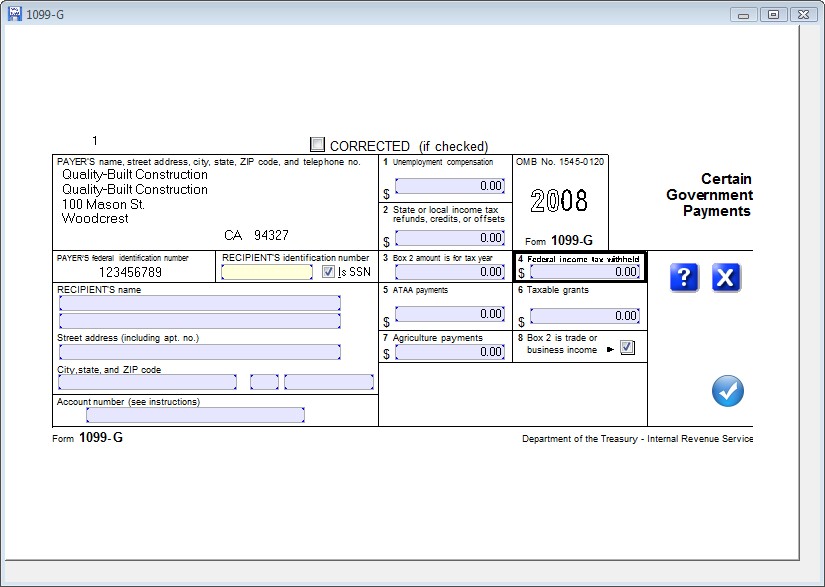

How to Read Your 1099G

Understanding the layout of the 1099G form is crucial for accurate tax reporting. Here’s a breakdown of the key sections:

Box 1: Unemployment Compensation

This box reports the total amount of unemployment benefits you received during the year. These payments are generally taxable and must be included in your income.

Box 3: State or Local Income Tax Refund

If you received a tax refund from your state or local government, it will be reported in this box. Depending on your circumstances, this amount may need to be included in your federal tax return.

Box 5: Other

This box reports any other payments you received from government entities, such as grants or subsidies. The description of these payments is usually provided in Box 10.

By carefully reviewing each box, you can ensure that you accurately report all relevant income on your tax return.

Filing Taxes with 1099G

Once you’ve received your 1099G form, it’s time to incorporate the information into your tax return. Here’s how:

- Report Unemployment Compensation: Include the amount from Box 1 on your Form 1040 or Form 1040-SR.

- Report Tax Refunds: If applicable, report the amount from Box 3 on your federal tax return.

- Include Other Payments: Ensure that any payments listed in Box 5 are properly accounted for.

Using tax software or consulting a tax professional can simplify this process and help ensure accuracy.

Common Questions About 1099G

Many taxpayers have questions about the 1099G form. Below are some frequently asked questions:

Is Unemployment Compensation Taxable?

Yes, unemployment benefits are generally considered taxable income. The amount reported in Box 1 of your 1099G form should be included in your total income for the year.

Do I Need to Report State Tax Refunds?

It depends on whether you itemized deductions in the previous year. If you did, the refund may need to be reported as income on your federal tax return.

What Happens If I Don’t Receive My 1099G?

If you don’t receive your 1099G by January 31st, contact the issuing agency to request a copy. You can still file your taxes without the form, but it’s important to ensure that you accurately report all relevant income.

Avoiding Common Mistakes

Mistakes on your tax return can lead to penalties or audits. Here are some tips to avoid common errors related to the 1099G form:

- Double-check the amounts reported on your 1099G against your records.

- Ensure that all income is properly reported on your tax return.

- Consult a tax professional if you’re unsure about any aspect of the form.

By taking these precautions, you can minimize the risk of errors and ensure a smooth tax filing process.

Using Tax Software for 1099G

Tax software can simplify the process of incorporating your 1099G information into your tax return. Many popular programs, such as TurboTax and H&R Block, offer step-by-step guidance for entering 1099G data. These tools can help ensure accuracy and reduce the likelihood of errors.

When using tax software, follow these tips:

- Enter all information from your 1099G form accurately.

- Review the software’s recommendations for reporting each box.

- Take advantage of any additional resources or FAQs provided by the software.

Conclusion

The 1099G form is an essential document for taxpayers who have received unemployment benefits, tax refunds, or other government-related payments. By understanding its purpose and components, you can ensure accurate tax reporting and compliance with federal laws. Whether you choose to file manually or use tax software, taking the time to review your 1099G carefully can help you avoid potential pitfalls.

We encourage you to share this article with others who may benefit from it and leave a comment if you have any questions or additional insights. For more information on tax-related topics, explore our other articles and resources. Remember, staying informed is the key to successful tax planning!

For further reading, consider consulting the IRS website or reaching out to a certified tax professional for personalized advice.

Savage Def Leppard: A Deep Dive Into The Iconic Rock Band

John McPhee Army Awards: A Comprehensive Exploration Of His Achievements And Legacy

Julie Rosendo: A Rising Star In The World Of Entertainment

What Is a 1099 Form and How to Handle It

Form 1099G PDF Tax In The United States Taxes

Entering & Editing Data > Form 1099G