What Is A 1099-G: A Comprehensive Guide To Understanding Your Tax Document

Each year, millions of Americans receive a 1099-G form, yet many are unsure of its purpose or importance. The 1099-G is a critical tax document that reports certain types of government payments you may have received during the previous year. Whether you're self-employed, received unemployment benefits, or had other government-related income, understanding the 1099-G is essential for accurate tax filing.

As tax season approaches, it's important to familiarize yourself with this document and its implications. Misunderstanding or ignoring the 1099-G can lead to errors in your tax return, potentially resulting in penalties or audits. This article will break down everything you need to know about the 1099-G, ensuring you're well-prepared for tax season.

From defining what the 1099-G is to exploring its various components and how it impacts your tax obligations, we'll provide actionable insights to simplify your tax process. Let's dive in!

Read also:Mexico Codigo A Comprehensive Guide To Understanding And Navigating The Mexican Code System

Here’s a quick overview of what we’ll cover:

- What is a 1099-G?

- Types of Income Reported on a 1099-G

- Who Receives a 1099-G?

- Important Sections of the 1099-G

- How to Use the 1099-G When Filing Taxes

- Common Mistakes to Avoid

- 1099-G and Unemployment Benefits

- State-Specific Information

- Frequently Asked Questions About 1099-G

- Conclusion and Next Steps

What is a 1099-G?

The 1099-G form is an IRS tax document issued by government agencies to report certain types of income you may have received during the tax year. This includes unemployment benefits, state tax refunds, and other government payments. The "G" in 1099-G stands for "government payments," highlighting its purpose.

Unlike the W-2 form, which is issued by employers to report wages and salary, the 1099-G focuses specifically on payments made by government entities. Understanding this distinction is crucial, as it affects how you report your income on your federal tax return.

Why is the 1099-G Important?

The 1099-G provides essential information for accurate tax reporting. For example, if you received unemployment benefits, those payments are taxable and must be reported on your federal return. Ignoring this form could result in underreporting your income, leading to penalties or interest charges from the IRS.

- It ensures all government-related income is accounted for in your tax return.

- It helps prevent discrepancies between your reported income and IRS records.

- It provides clarity on any state tax refunds you may have received, which could impact your federal tax liability.

Types of Income Reported on a 1099-G

The 1099-G covers a variety of income sources, each of which must be reported on your tax return. Below are some common types of income listed on this form:

- Unemployment Compensation: Payments received from state unemployment agencies.

- State or Local Income Tax Refunds: Any refunds you received from state or local tax authorities.

- Other Government Payments: This includes disaster relief payments, agricultural payments, and other forms of assistance provided by government entities.

It's important to review each section of the 1099-G carefully to ensure all applicable income is included in your tax calculations.

Read also:Dakota Tyler Real Name Unveiling The Truth Behind The Screen Persona

Who Receives a 1099-G?

Not everyone will receive a 1099-G. This form is typically sent to individuals who:

- Received unemployment benefits during the tax year.

- Got a state or local tax refund.

- Were recipients of other government payments, such as disaster relief funds.

If you fall into any of these categories, you should expect to receive a 1099-G by January 31st of the following year. However, if you don't receive it by mid-February, contact the issuing agency to request a copy.

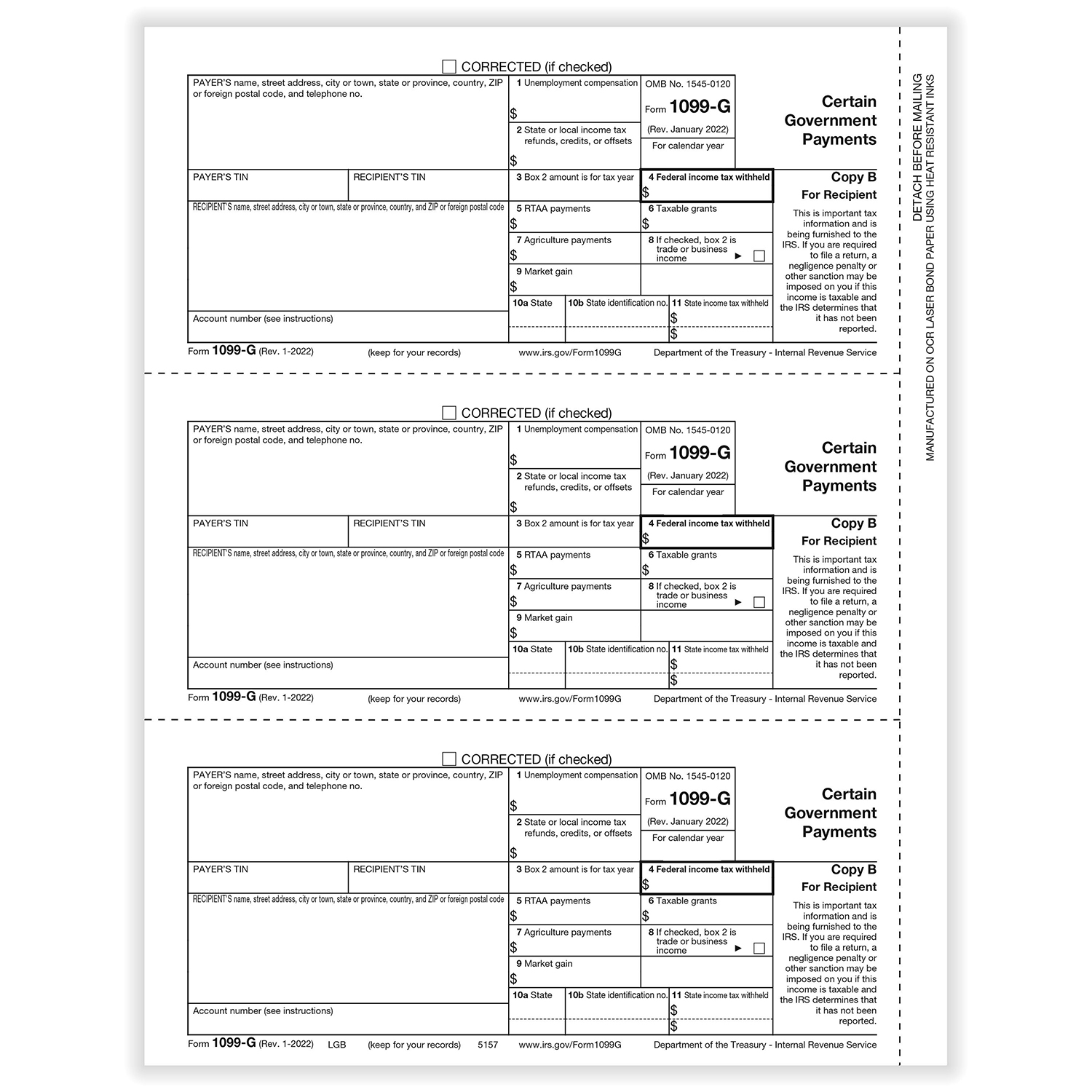

Important Sections of the 1099-G

The 1099-G form is divided into several sections, each detailing specific types of income. Understanding these sections is key to accurately reporting your tax information.

Box 1: Total State/Local Income Tax Refunds, Credits, or Offsets

This box shows the total amount of state or local tax refunds you received during the year. If this amount exceeds the taxes you paid in the previous year, it may be considered taxable income on your federal return.

Box 3: Total Unemployment Compensation

Here, you'll find the total unemployment benefits you received. These payments are generally taxable and must be included in your gross income when filing your federal taxes.

Box 7: Other Income

This section covers any other government payments you received, such as disaster relief funds or agricultural subsidies. Each type of payment is coded to help identify its source.

How to Use the 1099-G When Filing Taxes

Once you receive your 1099-G, it's important to incorporate the information into your tax return. Here's a step-by-step guide:

- Review the Form: Carefully check all boxes and amounts to ensure accuracy.

- Report Income: Enter the relevant amounts from the 1099-G into the appropriate sections of your tax return. For example, unemployment compensation goes on Form 1040, line 8a.

- Adjust for Refunds: If you received a state tax refund, determine if it's taxable based on the difference between the refund amount and the taxes you paid in the previous year.

Using tax preparation software or consulting a tax professional can simplify this process and ensure compliance with IRS regulations.

Common Mistakes to Avoid

Misunderstanding the 1099-G can lead to costly errors. Here are some common mistakes to watch out for:

- Ignoring the Form: Failing to report income listed on the 1099-G can result in penalties or audits.

- Incorrect Reporting: Entering the wrong amounts or omitting sections can lead to discrepancies with IRS records.

- Overlooking Refund Adjustments: Not accounting for state tax refunds properly can affect your federal tax liability.

Double-check all entries and consult a tax advisor if you're unsure about any section of the form.

1099-G and Unemployment Benefits

With the rise in unemployment claims during economic downturns, many individuals have received unemployment benefits reported on the 1099-G. Here's what you need to know:

- Taxability: Unemployment benefits are generally taxable and must be reported as income on your federal return.

- Withholding Options: You can choose to have federal taxes withheld from your unemployment payments by completing Form W-4V.

- Special Provisions: In some cases, portions of unemployment benefits may be excluded from taxable income due to legislative changes, such as the American Rescue Plan Act.

Stay informed about current tax laws and consult a professional if you're unsure about how to handle your benefits.

State-Specific Information

While the 1099-G is a federal form, state-specific rules may apply depending on where you live. Some states may require additional reporting or have different thresholds for taxability. For example:

- California: Unemployment benefits are taxable at the federal level but exempt from state taxes.

- New York: State tax refunds may be taxable if they exceed the amount of taxes paid in the previous year.

Check with your state tax agency for specific guidelines and requirements.

Frequently Asked Questions About 1099-G

Q: What happens if I don't receive my 1099-G?

If you don't receive your 1099-G by mid-February, contact the issuing agency to request a copy. You can still file your taxes without it by estimating the amounts based on your records, but obtaining the official form is recommended for accuracy.

Q: Are all government payments taxable?

No, not all payments reported on the 1099-G are taxable. For example, some disaster relief funds may be excluded from income. Always review the specific rules for each type of payment.

Q: Can I e-file if I haven't received my 1099-G?

Yes, you can e-file your taxes using estimated amounts, but it's best to wait until you have the official form to ensure accuracy and avoid potential amendments.

Conclusion and Next Steps

The 1099-G is a vital document for anyone who has received unemployment benefits, state tax refunds, or other government payments. By understanding its components and properly reporting the information, you can ensure a smooth and accurate tax filing process. Remember to:

- Review your 1099-G carefully before filing.

- Include all relevant income on your federal tax return.

- Consult a tax professional if you have questions or concerns.

Take action by gathering all necessary documents and preparing your return early. Share this article with others who may benefit from the information, and explore additional resources on our site for more tax tips and insights. Stay informed and take control of your financial future!

Data and references for this article come from authoritative sources, including the IRS website and state tax agencies, ensuring the information provided is accurate and up-to-date.

Sebastián Carvajal Children: A Comprehensive Guide To The Life And Family Of This Beloved Personality

Raspberry Pi Comparison Chart: A Comprehensive Guide For Tech Enthusiasts

Claire Saffitz Child: A Culinary Journey Through The Eyes Of A Master Chef

1099G Form 2025

What Is A 1099G Form? And What Do I Do With It?

1099G Recipient Copy B Formstax