What Is A 1099-G? A Comprehensive Guide To Understanding Your Tax Form

Understanding tax forms is crucial for anyone who files their taxes, and one of the forms you might encounter is the 1099-G. This form plays an essential role in helping taxpayers report certain types of income they received during the tax year. If you've received a 1099-G, it's important to know what it means and how it affects your tax return.

The 1099-G form is issued by government entities to individuals who received payments or refunds from state or local governments. Whether you're a freelancer, a business owner, or simply someone who received a tax refund, this form could be relevant to your tax situation. In this article, we will delve into the details of the 1099-G form, its purpose, and how it impacts your tax obligations.

By the end of this guide, you'll have a clear understanding of what the 1099-G form is, why it's important, and how to use it effectively when preparing your tax return. Let's dive in and explore everything you need to know about this critical tax document.

Read also:Taylor Swift Height Compared To Bruno Mars A Detailed Exploration

Table of Contents

- Introduction to the 1099-G Form

- Purpose of the 1099-G

- Types of Income Reported on the 1099-G

- When is the 1099-G Issued?

- Understanding the Boxes on the 1099-G

- How the 1099-G Affects Your Taxes

- Common Questions About the 1099-G

- Reporting the 1099-G on Your Tax Return

- How to Avoid Common Mistakes with the 1099-G

- Useful Resources for Understanding the 1099-G

Introduction to the 1099-G Form

The 1099-G form is an official IRS document used to report certain types of income that individuals receive from government entities. This form is typically issued by state and local governments to taxpayers who received payments such as unemployment compensation, tax refunds, or other government-related payments. Understanding the 1099-G is essential for anyone who wants to ensure accurate tax reporting and avoid potential penalties.

Why is the 1099-G Important?

The 1099-G serves as a record of income that may need to be included in your taxable income. It ensures that the IRS has a complete picture of all the income you've received during the tax year. By reporting this information accurately, you can avoid discrepancies that might lead to audits or additional taxes owed.

Purpose of the 1099-G

The primary purpose of the 1099-G form is to provide taxpayers with a detailed breakdown of payments they received from government entities. These payments can include unemployment benefits, tax refunds, or other types of government assistance. The IRS requires these forms to be issued so that taxpayers can accurately report their income on their tax returns.

Who Receives the 1099-G?

Not everyone will receive a 1099-G form. It is typically sent to individuals who:

- Received unemployment compensation during the tax year.

- Received a state or local tax refund.

- Were paid by a government entity for services rendered.

Types of Income Reported on the 1099-G

The 1099-G form covers a variety of income types. Some of the most common include:

- Unemployment Compensation: Payments received from unemployment benefits.

- Tax Refunds: Refunds issued by state or local governments.

- Other Government Payments: Includes payments such as disaster relief funds or other forms of assistance.

How to Identify the Type of Income

Each type of income is reported in a specific box on the 1099-G form. For example, unemployment compensation is typically reported in Box 1, while tax refunds are reported in Box 3. Understanding these distinctions is key to accurate reporting.

Read also:Unveiling The Thrills Of Hide And Seek Xev A Comprehensive Guide

When is the 1099-G Issued?

The 1099-G form is usually issued by January 31st of the following year. This gives taxpayers sufficient time to gather all necessary documents before the tax filing deadline. If you don't receive your 1099-G by this date, it's important to follow up with the issuing entity to ensure you have all the information you need for your tax return.

What to Do if You Don't Receive Your 1099-G

If you haven't received your 1099-G by the end of January, you should contact the issuing government agency. They can provide you with a copy or verify the information so you can proceed with your tax filing. Delays in receiving this form should not prevent you from filing your taxes on time.

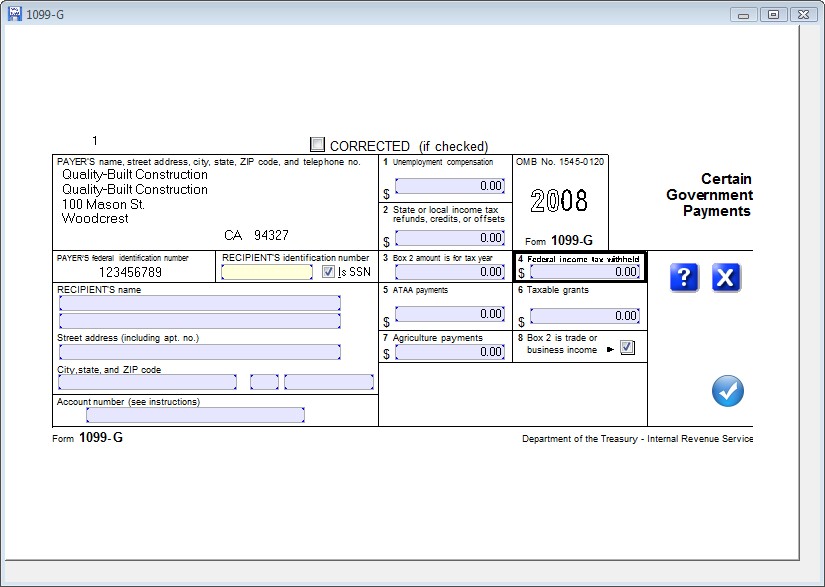

Understanding the Boxes on the 1099-G

The 1099-G form contains several boxes that correspond to different types of income. Here's a breakdown of the most important boxes:

- Box 1: Unemployment Compensation

- Box 3: State or Local Income Tax Refunds

- Box 4: Federal Income Tax Withheld

- Box 5: Other Income

What Each Box Means

Each box on the 1099-G form provides specific details about the payments you received. For example, Box 1 shows the total amount of unemployment compensation you received, while Box 3 indicates any state or local tax refunds you may have received during the year.

How the 1099-G Affects Your Taxes

The information on the 1099-G form can significantly impact your tax return. Depending on the type of income reported, you may need to include it in your taxable income or adjust your deductions accordingly. For instance, unemployment compensation is generally taxable, while state tax refunds may only be taxable if they exceed the amount of itemized deductions you claimed in the previous year.

Taxable vs. Non-Taxable Income

Not all income reported on the 1099-G is taxable. For example, certain government assistance programs may be excluded from taxable income. It's important to consult the IRS guidelines or a tax professional to determine which portions of your 1099-G income are taxable.

Common Questions About the 1099-G

Do I Need to Report the 1099-G on My Tax Return?

Yes, you must report the information from your 1099-G on your tax return. Failing to do so can result in penalties or an audit. The IRS receives a copy of your 1099-G, so it's crucial to ensure that your tax return matches the information provided.

Can I File My Taxes Without the 1099-G?

Yes, you can estimate the amounts reported on your 1099-G and file your taxes without the form. However, it's always best to obtain the official document to ensure accuracy. Once you receive the form, you can amend your tax return if necessary.

Reporting the 1099-G on Your Tax Return

To report the 1099-G on your tax return, you'll need to enter the relevant amounts in the appropriate sections of your tax forms. For example, unemployment compensation is reported on Form 1040, while state tax refunds are accounted for in Schedule 1. Make sure to follow the IRS instructions carefully to avoid errors.

Steps to Report the 1099-G

- Gather all necessary documents, including your 1099-G form.

- Enter the amounts from the 1099-G in the correct sections of your tax return.

- Double-check your calculations to ensure accuracy.

- Submit your tax return by the deadline.

How to Avoid Common Mistakes with the 1099-G

Mistakes on the 1099-G can lead to tax complications, so it's important to be vigilant. Some common errors include failing to report the correct amounts, not accounting for taxable portions of the income, or overlooking the form altogether. To avoid these issues, always verify the information on your 1099-G and consult with a tax professional if you're unsure.

Tips for Accuracy

- Compare your 1099-G with your personal records to ensure accuracy.

- Consult the IRS website for the latest guidance on reporting 1099-G income.

- Consider using tax software or working with a tax advisor to simplify the process.

Useful Resources for Understanding the 1099-G

For more information on the 1099-G form, you can refer to the following resources:

Kesimpulan

The 1099-G form is an important document that helps taxpayers accurately report income received from government entities. By understanding the purpose of the form, the types of income it covers, and how it affects your tax return, you can ensure compliance with IRS regulations and avoid potential penalties. Remember to report the information from your 1099-G correctly and seek professional guidance if needed.

We encourage you to share this article with others who may benefit from it and leave a comment below if you have any questions or insights. For more information on tax-related topics, explore our other articles and resources. Stay informed and take control of your financial future!

Madeline Clyne Naked: A Comprehensive Look At The Misunderstood Controversy

Madelyn Cline Nude: Debunking Myths And Understanding The Controversy

Mexican N Word: Understanding The Controversial Term And Its Cultural Implications

What Is a 1099 Form and How to Handle It

Form 1099G PDF Tax In The United States Taxes

Entering & Editing Data > Form 1099G