Mental Secrets Of Superior Investors: Unlocking The Mindset For Financial Success

Investing is more than just numbers and market trends; it's a mental game that requires a superior mindset to excel in the long run. The most successful investors in history have mastered their psychology and developed mental strategies that set them apart from the crowd. These mental secrets of superior investors are not only about financial knowledge but also about emotional discipline, patience, and strategic thinking.

In today's fast-paced financial world, understanding the psychological aspects of investing can make all the difference. This article dives deep into the mental strategies that top investors use to stay ahead of the game. Whether you're a beginner or an experienced investor, learning these secrets can help you refine your approach and improve your financial outcomes.

From managing emotions to leveraging cognitive biases, we'll explore the key principles that drive superior investment success. Let's uncover the mindset of the world's best investors and discover how you can apply their mental secrets to your own investment journey.

Read also:Exploring Rindianbabes A Comprehensive Guide To The Subreddit Community

Table of Contents

- Biography of Legendary Investors

- Key Traits of Superior Investors

- The Power of Emotional Control

- Thinking Long-Term: The Secret Weapon

- Mastering Risk Management

- Understanding and Leveraging Cognitive Biases

- The Role of Discipline in Investment Success

- Why Diversification Matters

- The Importance of Continuous Learning

- Conclusion: Applying the Mental Secrets

Biography of Legendary Investors

To truly understand the mental secrets of superior investors, it's essential to look at the lives and careers of some of the most iconic figures in the investing world. These individuals have not only achieved extraordinary financial success but have also left a lasting impact on the investment community.

Data and Biodata

| Name | Birth Year | Nationality | Net Worth | Notable Achievements |

|---|---|---|---|---|

| Warren Buffett | 1930 | American | $113 billion (as of 2023) | Chairman and CEO of Berkshire Hathaway; often referred to as the "Oracle of Omaha." |

| Ray Dalio | 1949 | American | $18.4 billion (as of 2023) | Founder of Bridgewater Associates, one of the world's largest hedge funds. |

| George Soros | 1930 | Hungarian-American | $8.6 billion (as of 2023) | Known for his successful bet against the British pound in 1992, earning him $1 billion in a single day. |

These investors have not only amassed incredible wealth but have also shared their wisdom through books, interviews, and lectures. Their stories serve as a testament to the power of mental resilience and strategic thinking in the world of finance.

Key Traits of Superior Investors

What sets superior investors apart from the rest? While each investor has their unique style, there are common traits that contribute to their success. These traits include:

- Patience: Superior investors understand that wealth is built over time, not overnight.

- Curiosity: They are constantly learning and adapting to new market conditions.

- Resilience: They can withstand market downturns and setbacks without losing focus.

- Independence: They think for themselves and avoid herd mentality.

These traits form the foundation of a successful investment mindset. By cultivating them, investors can improve their chances of achieving long-term financial success.

The Power of Emotional Control

One of the most critical mental secrets of superior investors is their ability to control their emotions. Emotional decision-making can lead to costly mistakes, such as panic selling during market downturns or impulsive buying during market rallies.

Managing Fear and Greed

Fear and greed are two of the most powerful emotions that influence investor behavior. Superior investors recognize these emotions and develop strategies to mitigate their impact. For example, they may set predefined rules for buying and selling to avoid impulsive decisions.

Read also:Madeline Cline Nude Debunking Myths Exploring Facts And Understanding Privacy

Research shows that emotional investing can lead to underperformance. According to a study by Dalbar, the average investor underperforms the market by a significant margin due to poor timing decisions driven by emotions.

Thinking Long-Term: The Secret Weapon

Superior investors are known for their long-term perspective. They understand that markets are cyclical and that short-term fluctuations should not dictate their investment strategy. This mindset allows them to stay focused on their goals and avoid reacting to market noise.

The Power of Compounding

Compounding is one of the most powerful forces in investing. By reinvesting earnings over time, investors can achieve exponential growth in their portfolios. Superior investors harness the power of compounding by maintaining a disciplined approach and avoiding unnecessary portfolio turnover.

For example, Warren Buffett has famously said, "Time is the friend of the wonderful company, the enemy of the mediocre." This highlights the importance of patience and long-term thinking in achieving superior investment results.

Mastering Risk Management

Risk management is a critical component of any successful investment strategy. Superior investors understand that risk cannot be eliminated, but it can be managed effectively. They use tools such as diversification, stop-loss orders, and position sizing to protect their portfolios from significant losses.

Diversification: Spreading the Risk

Diversification is one of the most effective ways to manage risk. By spreading investments across different asset classes, sectors, and geographies, investors can reduce the impact of a single poor-performing investment on their overall portfolio.

A study by Morningstar found that diversified portfolios tend to outperform concentrated portfolios over the long term, highlighting the importance of this strategy.

Understanding and Leveraging Cognitive Biases

Cognitive biases are mental shortcuts that can lead to irrational decision-making. Superior investors are aware of these biases and take steps to mitigate their impact. By understanding how cognitive biases affect investor behavior, they can make more rational decisions.

Common Cognitive Biases in Investing

- Anchoring Bias: Over-reliance on initial information when making decisions.

- Confirmation Bias: Seeking out information that supports pre-existing beliefs while ignoring contradictory evidence.

- Loss Aversion: The tendency to fear losses more than value gains.

By recognizing these biases, superior investors can develop strategies to counteract them, leading to better investment outcomes.

The Role of Discipline in Investment Success

Discipline is a cornerstone of successful investing. Superior investors adhere to a well-defined investment process and avoid deviating from it, even in challenging market conditions. This discipline helps them stay focused on their long-term goals and avoid emotional decision-making.

Creating an Investment Plan

An investment plan serves as a roadmap for achieving financial success. It outlines an investor's goals, risk tolerance, and investment strategy. By sticking to their plan, investors can avoid impulsive decisions and maintain a consistent approach to investing.

Research shows that disciplined investors tend to outperform those who frequently change their strategies. A study by Vanguard found that investors who maintained a consistent asset allocation strategy achieved better returns than those who frequently adjusted their portfolios.

Why Diversification Matters

Diversification is a key principle of risk management and a mental secret of superior investors. By spreading investments across different asset classes, sectors, and geographies, investors can reduce the impact of a single poor-performing investment on their overall portfolio.

Benefits of Diversification

- Reduces portfolio risk

- Improves long-term returns

- Provides protection against market volatility

According to Nobel laureate Harry Markowitz, "Diversification is the only free lunch in finance." This highlights the importance of diversification in achieving superior investment results.

The Importance of Continuous Learning

Superior investors never stop learning. They are constantly seeking new knowledge and insights to improve their investment strategies. This commitment to continuous learning is a key factor in their success.

Resources for Learning

- Books: "The Intelligent Investor" by Benjamin Graham, "Thinking, Fast and Slow" by Daniel Kahneman

- Podcasts: "Invest Like the Best" by Patrick O'Shaughnessy, "The Investors Podcast" by Tracy Coenen

- Online Courses: Coursera, edX, and Khan Academy offer a wide range of finance-related courses.

By staying informed and continuously improving their skills, superior investors can adapt to changing market conditions and maintain their edge in the investment world.

Conclusion: Applying the Mental Secrets

In conclusion, the mental secrets of superior investors revolve around emotional control, long-term thinking, risk management, and continuous learning. By adopting these principles, investors can improve their chances of achieving financial success.

We encourage you to take action by implementing these strategies in your own investment journey. Leave a comment below sharing your thoughts on the article, and don't forget to explore our other resources for further learning. Remember, the path to financial success begins with the right mindset.

Unveiling The Secrets Of "Wah Toh Tit Tar": A Comprehensive Guide

Mel C Partner: A Comprehensive Exploration Of The Spice Girl's Personal And Professional Life

Mr Beast Political Party: A Comprehensive Guide To The Phenomenon Shaping Modern Politics

Institution of Investors Johannesburg

5 Secrets of Successful Investors

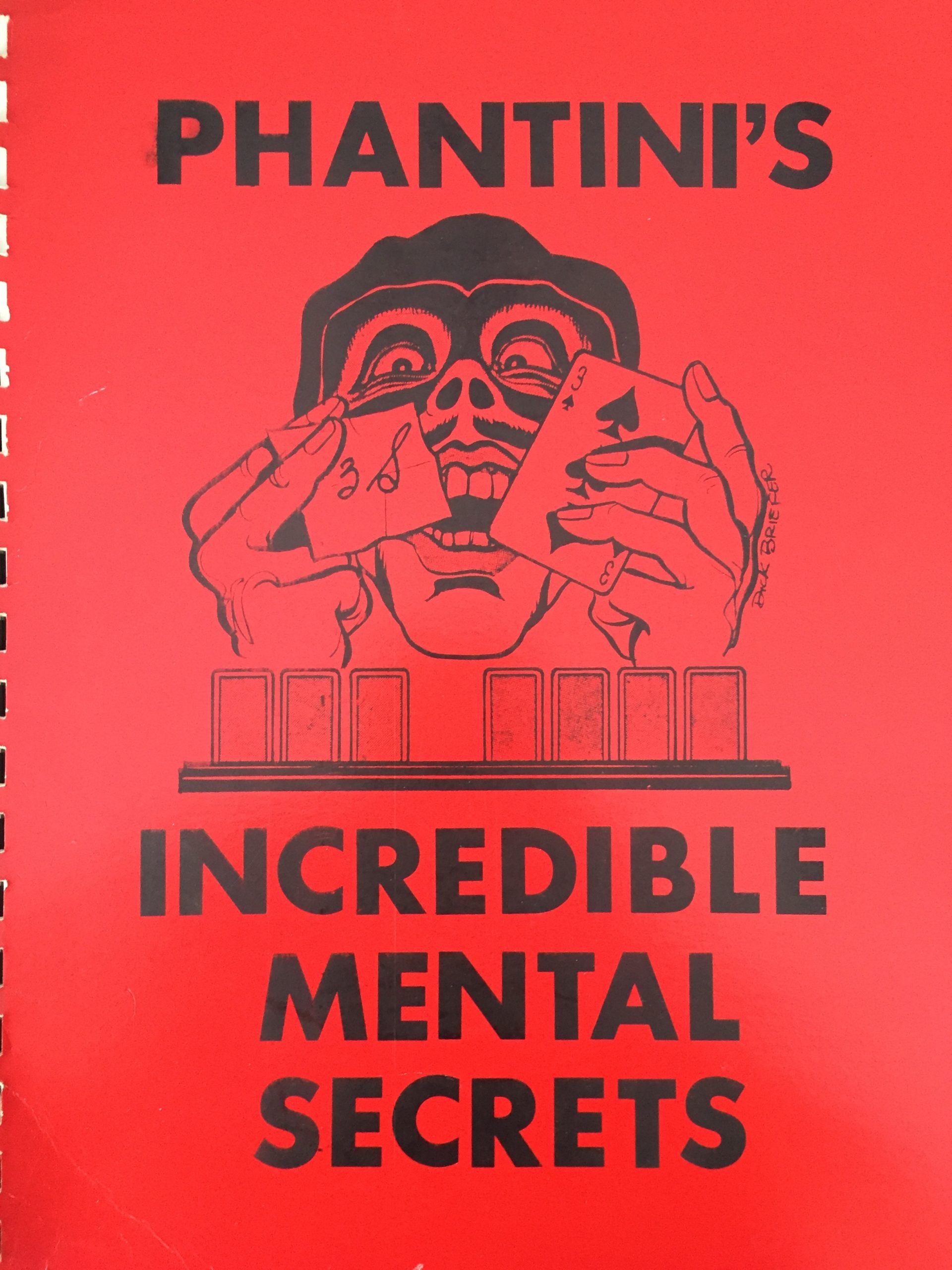

Incredible mental secrets Phantini Magicabra!